Jacksonville TX auto title loans provide quick cash but come with substantial risks, including vehicle repossession, high-interest rates, and strict repayment terms. To mitigate these dangers, explore safer alternatives like personal or credit cards and understand the risks of specialized secured loans. Repay early to save on interest, create a budget, prioritize high-interest debt, automate payments, and review spending habits. Refinance or consolidate other debts for lower rates. Build or improve your credit score during repayment by making consistent, timely payments while keeping your vehicle as collateral.

In Jacksonville, TX, auto title loans can offer quick cash but come with significant risks. This article guides you through understanding these loans and their potential pitfalls. We explore practical strategies to pay off your Jacksonville TX auto title loan early, saving you substantial fees and interest. Additionally, learn how to build credit responsibly while repaying your loan, securing a brighter financial future. Discover actionable steps to navigate this option safely and efficiently.

- Understanding Jacksonville TX Auto Title Loans and Their Risks

- Strategies to Pay Off Loans Early and Save Money

- Building Credit While Repaying Auto Title Loans in Jacksonville TX

Understanding Jacksonville TX Auto Title Loans and Their Risks

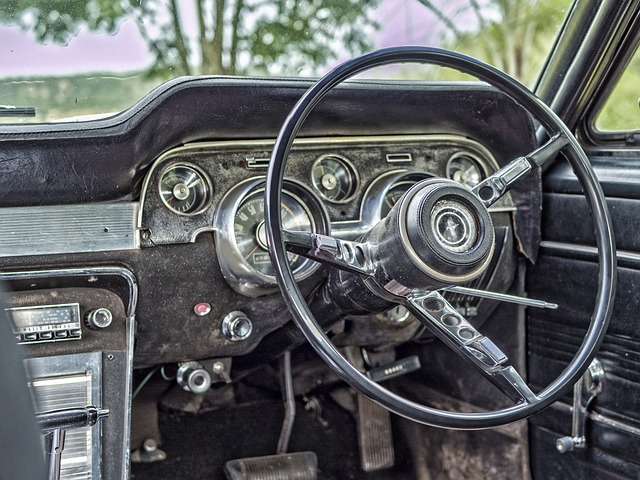

Jacksonville TX auto title loans are a type of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This option is popular for those needing quick cash, especially in emergencies. However, it comes with significant risks. If you default on these loans, lenders have the right to repossess your vehicle, leading to financial and logistical disruptions.

These loans often come with high-interest rates and strict repayment terms. While they can be a lifeline in urgent situations, borrowers must understand the potential consequences. It’s crucial to explore alternatives like personal loans or credit cards if possible, as these traditional options may offer better terms and avoid the risk of losing your vehicle. Additionally, for those considering specific types of secured loans such as truck title loans or boat title loans, a thorough understanding of the associated risks is paramount before making any decisions.

Strategies to Pay Off Loans Early and Save Money

Paying off Jacksonville TX auto title loans early can save a significant amount in interest charges, making it a smart financial move. Strategies to achieve this include creating a budget and sticking to it, prioritizing high-interest debt, such as auto title loans, and automating loan payments through direct debits from your checking account. Regularly reviewing your spending habits and cutting back on non-essential expenses can free up extra funds for loan repayments.

Additionally, consider refinanacing or consolidating other debts to reduce overall interest rates and make them more manageable. A thorough understanding of your budget and financial goals is crucial in determining the best approach. For instance, if you have a stable income and a buffer in your savings account, you might be able to allocate a larger portion of your funds towards repaying Fort Worth loans more quickly. Remember, a well-planned strategy that aligns with your financial solution can help you overcome debt faster while minimizing stress and maximizing savings.

Building Credit While Repaying Auto Title Loans in Jacksonville TX

While repaying your Jacksonville TX auto title loan, one strategic step to take is focusing on building or improving your credit score. This becomes significant in the long term as it opens up opportunities for better financial deals in the future, including potential savings on other types of loans and even insurance rates. A robust credit history demonstrates responsible borrowing and repayment habits to lenders.

There are several ways to achieve this. Firstly, ensure consistent and timely repayments. Even though auto title loans in Jacksonville TX are designed with a shorter term, maintaining punctual payments shows a commitment to financial responsibility. Secondly, consider keeping your vehicle as collateral for the loan can help maintain a positive association between your creditworthiness and vehicle ownership, which is especially beneficial if you’re considering other types of secured loans like Houston Title Loans or Truck Title Loans in the future. Remember that building credit responsibly involves patience, consistent effort, and adhering to responsible borrowing practices – an investment that will pay dividends over time.

Paying off your Jacksonville TX auto title loan early is a smart financial move that can save you significant interest costs. By understanding the risks and implementing strategies like budgeting, cutting unnecessary expenses, and building credit responsibly, you can navigate the challenges of these loans while maximizing savings. Remember, while auto title loans can provide quick cash, proactive repayment plans are key to financial well-being in the long term.