Jacksonville TX auto title loans offer swift financial aid by using vehicle value as collateral with simple eligibility criteria and minimal documentation. Borrowers can select from flexible repayment plans, including weekly/bi-weekly installments, and consolidate debts for better financial management. Plans are structured around individual comfort levels, promoting stability and avoiding penalties or repossession, benefiting those with unpredictable income streams. Lenders provide control over loan terms, allowing faster repayment or extended schedules for a more relaxed schedule.

Jacksonville TX auto title loans offer a unique financial solution for those needing quick cash. In this comprehensive guide, we demystify these loans and focus on payment plans, providing a clear overview for local residents. Understanding your options is crucial when considering a Jacksonville TX auto title loan. This article breaks down the basics, explores flexible payment structures, and navigates various strategies to gain better financial control.

- Understanding Jacksonville TX Auto Title Loan Basics

- Payment Plan Flexibility Explained in Detail

- Navigating Options for Better Financial Control

Understanding Jacksonville TX Auto Title Loan Basics

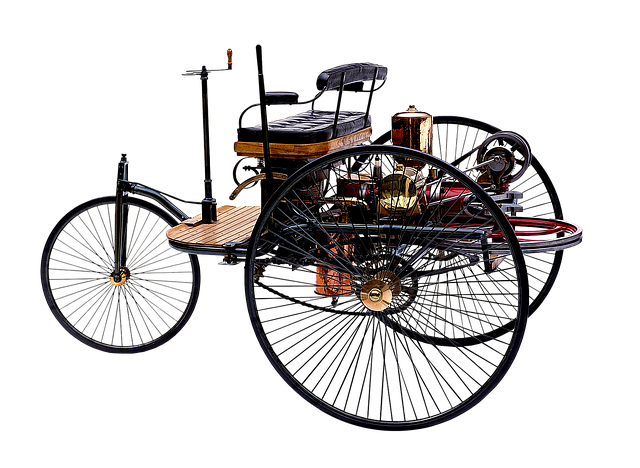

In Jacksonville TX, auto title loans offer a unique financial solution for individuals seeking quick access to cash. This type of loan utilizes the value of your vehicle as collateral, allowing lenders to provide funds based on its current market worth. Unlike traditional loans that require extensive documentation and strict credit checks, car title loans in Jacksonville TX often have simpler eligibility criteria. Borrowers can apply using an online application, providing proof of income and a valid vehicle registration. This makes them an attractive option for those with less-than-perfect credit or limited banking history.

One significant advantage of Jacksonville TX auto title loans is the flexibility they offer in terms of repayment plans. Lenders typically work with borrowers to establish a payment schedule that aligns with their financial capabilities, often involving weekly or bi-weekly installments. Moreover, these loans can facilitate debt consolidation by providing a lump sum to pay off multiple debts, potentially reducing monthly payments and simplifying financial management for Jacksonville residents.

Payment Plan Flexibility Explained in Detail

One of the most attractive aspects of Jacksonville TX auto title loans is the extensive range of payment plan options available to borrowers. This flexibility ensures that individuals from diverse financial backgrounds can access needed funds, catering to both short-term and long-term needs. Payment plans for these loans are structured around the borrower’s comfort level and ability to repay, often involving fixed monthly installments.

These plans allow borrowers to maintain control over their vehicle ownership throughout the loan term. Unlike traditional mortgages or personal loans, where payment delays can result in penalties or repossession, Jacksonville TX auto title loans offer a safety net. Borrowers can continue driving their vehicles as long as they make timely payments according to their chosen plan. This stability is particularly beneficial for those with unpredictable income streams, enabling them to budget effectively and avoid potential financial strain.

Navigating Options for Better Financial Control

When considering a Jacksonville TX auto title loan, understanding your payment options is crucial for regaining financial control. These loans are designed to offer flexible solutions for borrowers seeking quick cash. Lenders in Jacksonville often provide various repayment plans tailored to individual needs, ensuring manageable monthly installments. This approach allows borrowers to maintain their financial stability while accessing the funds they require.

Choosing the right loan terms can significantly impact your overall experience. You may opt for shorter Loan Terms for faster repayment and interest savings or extend them for a more relaxed payment schedule. San Antonio Loans, known for their diverse lending practices, offer similar options, enabling borrowers to align their repayment plans with their financial capabilities. This flexibility ensures that you stay in control of your finances throughout the loan period.

Jacksonville TX auto title loans offer a flexible solution for those needing quick cash. By understanding the basic principles and leveraging payment plan options, borrowers can gain financial control while maintaining their vehicle’s equity. Navigating these choices allows individuals to select terms that fit their unique circumstances, ensuring a manageable repayment process without compromising daily life. Whether choosing a standard or extended repayment plan, Jacksonville TX auto title loan providers offer various options to suit diverse needs.